TaxTax News Tako Nadibaidze01/31/2024

Tako Nadibaidze01/31/2024

IRS Urges Taxpayers to File Returns Promptly, Regardless of Pending Tax Bill Decisions

AccountantTaxTax News Tako Nadibaidze01/29/2024

Tako Nadibaidze01/29/2024

Small Businesses Face Heftier Fines as BOI Reporting Penalties Increase

TaxTax News Tako Nadibaidze01/26/2024

Tako Nadibaidze01/26/2024

Tax Overhaul Alert: 2024 Brings Audits for Self-Employed and Small Businesses

TaxTax News Tako Nadibaidze01/25/2024

Tako Nadibaidze01/25/2024

Tax Clarity Revolution: Notices Redesigned for Easy Understanding!

TaxTax News Tako Nadibaidze01/24/2024

Tako Nadibaidze01/24/2024

Tax Deadline Extended for Storm-Affected Connecticut Residents Until June 17, 2024

TaxTax News Tako Nadibaidze01/23/2024

Tako Nadibaidze01/23/2024

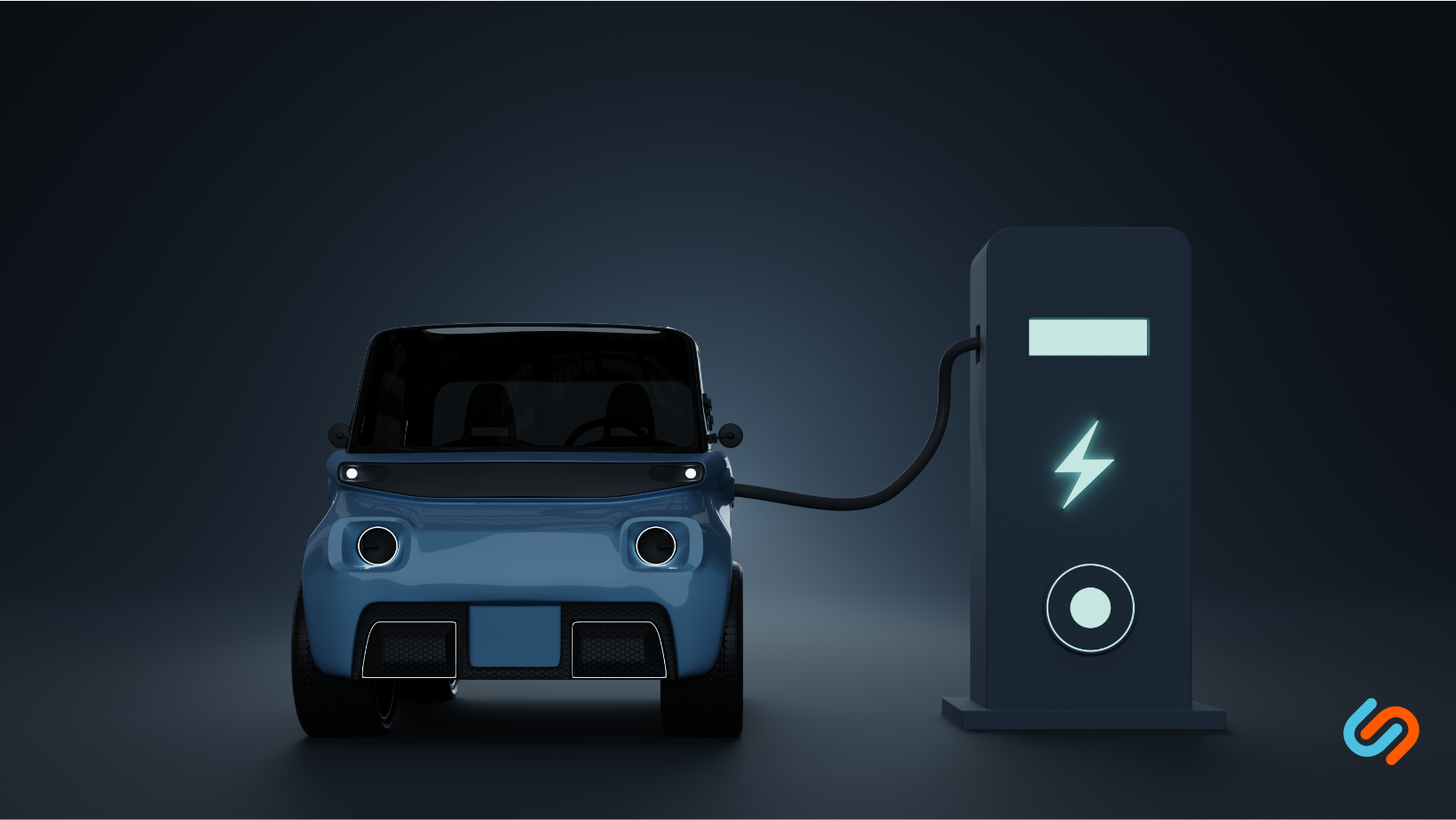

IRS Boosts EV Adoption with 30% Tax Credit for Charging Stations

AccountantTaxTax News Tako Nadibaidze01/18/2024

Tako Nadibaidze01/18/2024

Digital Asset Reporting Relief for Businesses and Freelancers

TaxTax News Tako Nadibaidze01/17/2024

Tako Nadibaidze01/17/2024